Planning for your retirement is important. You need to be aware of how you are spending your money. There are several things you can do in order to ensure that your money will last as long as possible. You can set goals, invest, and take care of long-term care. You'll feel secure knowing you have a plan in place to manage your finances.

Social Security

You need to be familiar with your Social Security benefits in order to plan for retirement. In most cases, you'll be eligible to collect benefits as early as 62. Not claiming benefits early enough could result in a substantial reduction in your benefits. This is especially true of women, who are more likely to live longer lives but make less.

Investing

As you approach retirement, your investments should be diversified to minimize risks and maximize returns. Diversification helps to reduce market volatility, inflation, and smoothes out returns. Diversification may allow you to retire earlier and enjoy a greater quality of your life. However, you should consult a financial professional before making any decision about your retirement plan.

Long-term care insurance

It is important to plan for long-term care insurance. As long-term care costs rise, it's vital to have the right coverage. Inflation protection is also an important feature to look for in a policy.

Saving for retirement

A key part of financial planning is saving money for retirement. Planning for retirement should be started decades before you anticipate that you will need it. This will help you plan more firmly and calmly when the time comes. Social Security may help with some expenses during retirement but it is not likely to cover all. Also, you will need to account for other sources of income like annuities, pensions, or the proceeds from selling your house or renting it out.

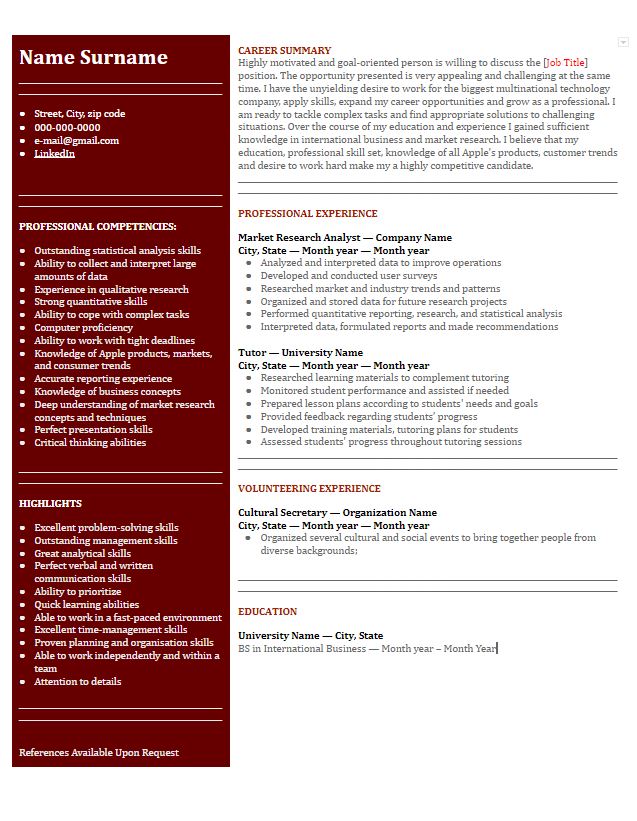

Investing with a traditional IRA and 401 (k)

A IRA or individual retirement account allows the participant choose from a list of investments. This type retirement plan has no investment guarantees and the income you receive will depend on the returns. These plans include 401k, 403(b), and 457 profit-sharing programs. These retirement plans often use diversification. Diversification is the practice of spreading your principal over different markets and sectors. It protects you from the possibility that a single security will lose its value.

Home equity

You can increase your retirement savings by investing in home equity. But, there are some potential risks. If you default on your loan, you could lose your home and have to sell it. Another option is downsizing your home and renting it out.

Investing in a 401(k)

To save money for retirement, you may be able to invest in a qualified 401(k). This plan is offered by many employers and can be joined at any time. Most employers match the amount of money you put into their plan. Talk to your human resource department for more information about your company's plans.

Investing in a traditional IRA

If you are looking to save money for your retirement, you should consider investing in a traditional IRA. This type of account allows you to make pre-tax contributions and your money grows tax-deferred. During your retirement, you will pay income tax on the money you withdraw. You can open a traditional IRA with a bank, brokerage, or robo-advisor. These institutions offer savings accounts as well as certificates of deposits, which could be a good option to build your retirement fund.